The recovery rally from October continued in November, but with less steam. Stock markets on both sides of the Atlantic Ocean climbed but Europe outperformed significantly, while the US large caps just managed to stay in positive terrain. Once again, the continuous slide in oil prices also affected large energy companies.

Among US equities, the energy price influence was exhibited by strong outperformance of small caps against large caps. The Russell 2000 added more than 3% during November.

In Europe, the German DAX gained strength again and moved up by 5%. Within our EU index rotation the index ranked in front of the Euro Stoxx and MDAX. The last one mentioned was still selected in November. Year to date, the MDAX delivered nearly twice the return of its big brother.

Across the five Emerging Markets we cover in our EM index rotation, return differences were quite small. One reason might be less interest of investors to select single countries in that category compared to a more general decision for or against an allocation to Emerging Markets. Universal reluctance to act before the FED rate decision and waiting for EM currencies to move more in favor of foreign investors might be the crucial factors.

On December 16th, the FED finally announced the rate hike which was already expected by the majority of market participants. Risk assets across the board jumped in direct sequence. The following trading days showed a mixed picture.

Our Strategies in November

[This part is only available to subscribers of our monthly newsletter. Please feel free to register here.]

Oil in Focus

Oil is on a downward path since summer 2014 and reached new lows in the last few days. The effect oil has on the global economy is second to none in the tradable commodity space. The direct and implied effects on other commodities and other asset classes, e.g. equities and corporate bonds, ask for a model to analyze oil.

Profits should be reaped from the fast and large movements of the commodity in both directions. The strategy utilized for that purpose has an opportunistic footing. Only when the model exhibits a sufficiently high probability for a move in either direction, a position is determined. We allow ourselves this luxury as we do not claim to have an opinion on oil all the time. It does no collide with our efforts to improve the strategy on an ongoing basis and achieve a higher share of time for which signals are delivered.

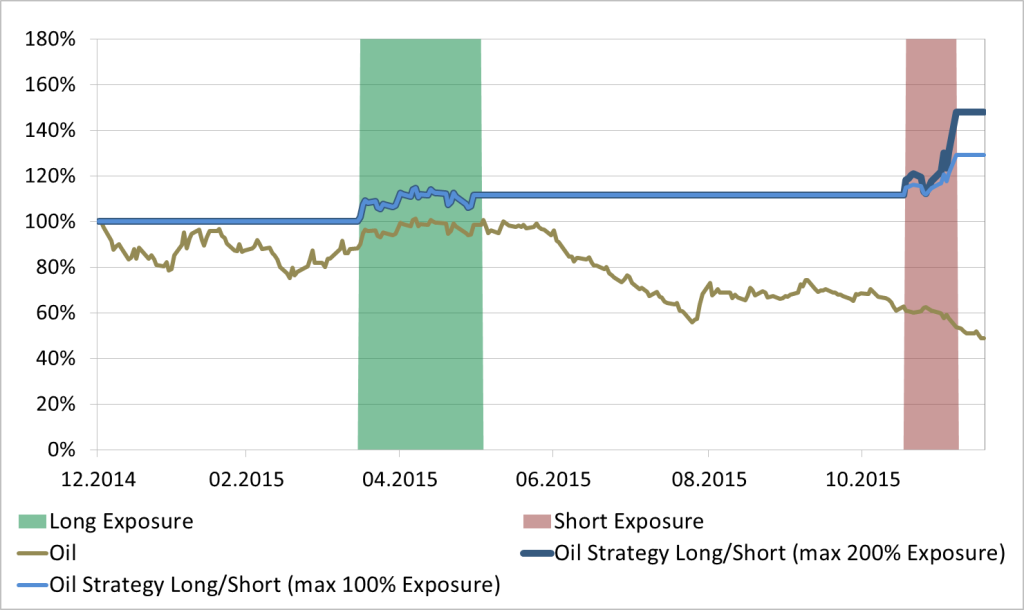

During the current year, only for 20% of the time a signal was delivered. In spring, a positive signal lead to a long position. A short position came from a negative signal, a few weeks ago. For the remaining 80% of trading days, the allocation reserved for oil could be utilized to allocate to stocks, bonds or cash.

The very short time span with exposure to the energy commodity was sufficient to achieve a performance of 30%, year to date. This describes the unlevered strategy. The strategy with leverage (max. 200% exposure) receives a small allocation within our global macro strategy and stands at +50%, measured from the start of the year.

The following chart shows the performance of both strategy versions (with and without leverage) compared to oil. The green background exhibits the time span with a long signal while the red background is the period for which the model determined short exposure.

Outlook:

The obligatory year end or Christmas rally failed to materialize, up to this point in time. Since the FED decided to increase rates, the markets exhibit an increased volatility as they did the weeks before the announcement. In addition, a lack of impetus and of liquidity at year end supports the volatility levels.

Even if the last few trading days of 2015 could bring back an upward trend for equities and other risk asset classes, the year will go down in history as a negative one for many strategies and asset classes. The significant slide of commodity prices (continued from 2014), the crash in August, the sell-off in high yields in December, and a strong drawdown with a synchronous move of different asset classes at the beginning of December, shows how challenging the second half of 2015 was. It was crucial to have participated in the rally, especially of European equities, at the beginning of the year.

It is very uncertain what 2016 can offer. Uncertainty might be higher than usual at the turn of a year. It could be essential to follow what effects the rate hike has on growth and employment. How will the US dollar trade as a consequence from according interest rate and inflation expectations? Will inflation return? Will continuously falling commodity prices have negative or even positive effects on growth? For 2016, we believe that flexibility and assumptions focused on robustness – both ingredients of our strategies and strategy development – will be helpful in a changing interest rate and asset allocation environment. Especially, the freedom to systematically time and leave markets or to even benefit from downward moves needs to be appreciated after seven years of bull markets. Bond markets moved in one direction for even 30 years.

The latest issue of TRADERS‘ magazine UK features our article on the market timing and rotation strategy for drawdown periods. Read the article