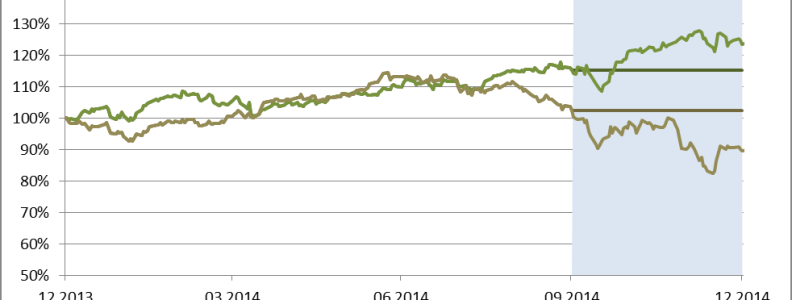

A remarkable recovery of global stock markets delivered up to double digit returns, in October. Our strategies had been prepared and could therefore benefit – in some cases disproportionately – from the recovery. With the newest data and with statements from central bankers, a first rate hike in December is considered a safe bet.

Not often you can find a month like the last one. US stocks, their European peers, and Chinese stocks as well moved up by more than 8%, in October. Such a strong upward leap happens after significant and fast downward moves, as seen in the previous two months. In our last monthly review, we pointed to a study that shows this relationship. A simple strategy that should benefit from the findings has been developed. It delivered a signal by Mid-October, the seventh within the last four years. By the end of October, the signal was still active and delivered a positive return as in all six instances before. More can be found in the article “Embrace the next Stock Market Drawdown” which we published in January.

Our Strategies in October

[This part is only available to subscribers of our monthly newsletter. Please feel free to register here.]

Again and again, the NASDAQ and the MDAX were the indices of choice in their corresponding US and EU index rotation strategy. With a remarkable consistency these two indices had been selected almost constantly over the last two years. The success of that choice can be measured in the return figures. The NASDAQ is more than 9% in front of the next best index in the US index rotation while the MDAX is more than 15% in front, only for this calendar year.

Outlook

In the next few days and weeks, even the last market participant will anticipate a FED rate hike for December. With the rate hike or even with its anticipation, a rotation should not only happen across asset classes but also within the equity universe. It should then be no surprise that investor’s favorite stocks will not perform as well as more neglected equity segments against the broad market in the recovery move and over the next weeks.

Taking a look on the overall equity market, no convincing reasoning is on the horizon for an end of the long-term upward trend. Depending on the measure, the earning seasons was the worst since 2009. The main reason and driver is the energy sector. The effect and the negative numbers had been priced into the very negative expectations upfront.

With the last few weeks of the year, one of the most robust seasonal factors is on the side of the bulls. Almost each year the Christmas rally can be observed and is often the best explanation for rising stock prices at the end of the year.