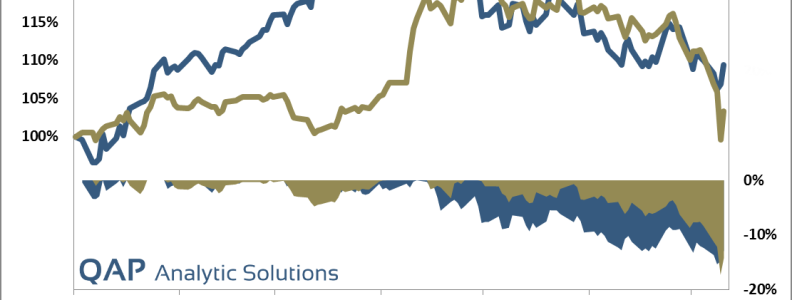

News over the last few days suggest that amid the Greek debt crisis, a potentially more important China crisis has emerged. Looking at the following chart, one can see a nearly identical downward move of German and Chinese (Hong Kong) stock markets. Continue reading

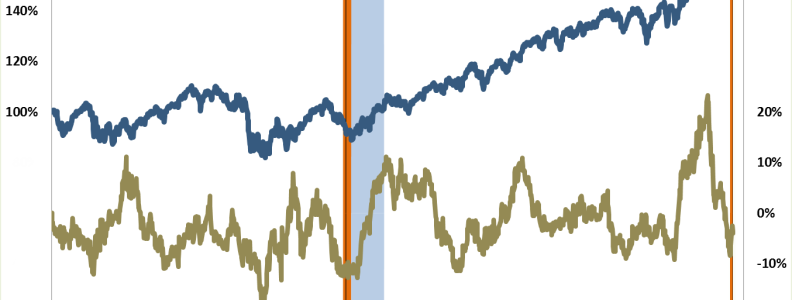

European Equities driven by China or Greece?